6 kalma With English Urdu Translation and Transliteration. There are six kalams and numbers are assigned by the Ajam Muslim scholars due to the importance of this kalmas. It should be noted that out of the 6 kalmas, the words of the first 4 kalmas are definitely proven by the hadiths and the words of the fifth and sixth kalmas are given in different hadiths and are taken from the different supplications that are present in the hadiths.

In the subcontinent of Pakistan and India, some prayer words and glorification in the name of Shash Kalma (six kalmas) are very strictly memorized to children.

Refrences of 6 kalmas: The first kalma is in "Kanz al-Umal" and "Mustadrak Hakim", the second kalma is in "Ibn Majah" and "Bukhari", the third kalma is in "Musnaf Ibn Abi Shaiba" and "Ibn Majah".the fourth kalma is found in "Musnaf Abd al-Razzaq al-Sanaani", "Musnaf Ibn Abi Shaiba" and "Sunan Tirmidhi" and the words of the remaining two kalmas are mentioned different hadiths.

6 kalma with Urdu Translation

First Kalma tayyaba with Urdu Translation

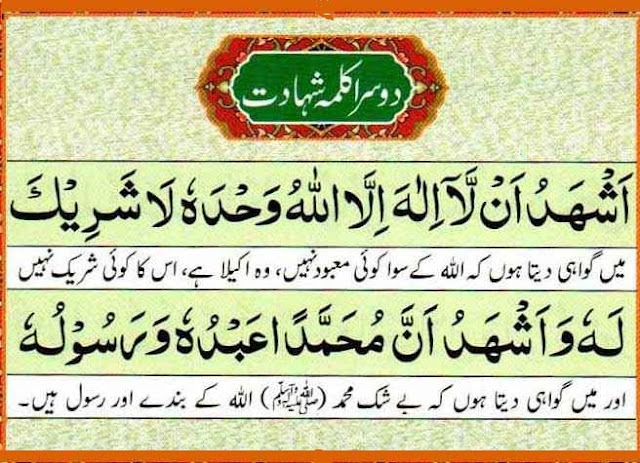

Second Kalima Shahadat with Urdu Translation

Third Kalma tamjeed with Urdu Translation

Fourth Kalima tauheed with Urdu Translation

Fifth Kalma astaghfar with Urdu Translation

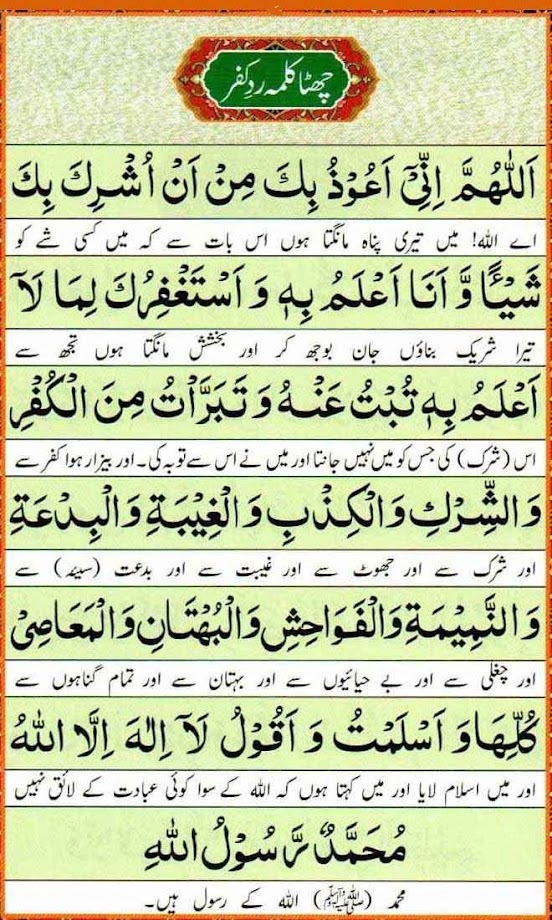

Sixth Kalma Radde kufr with Urdu Translation

6 kalma Recitation

Reality and Importance of 6 kalmas

First Kalma: The first kalma is called is Tayyab. This kalma is proved by the hadiths. The transliteration words of this kalma is a ilaha illallah muhammadur rasulullah. The meaning of this kalma is There is none worthy of worship except Allah, Muhammad (PBUH) is the Messenger of Allah. The first kalma defines the fundamental faith compulsory to become a Muslim.

Kalima Tayyaba is one of the foundations of Islam. Rather, say that Kalima Tayyaba is the key of Islam. The first pillar of Islam is Kalima Tayyaba. There are countless virtues of this word, one of which is that the person who recite this words with a true heart will definitely go to heaven. It is important for the reciter of Kalima Tayyaba to know what the meaning of this Kalima. Secondly, for the reader of the this kalma should have perfect faith. Verily, Allah is the only God and the Holy Prophet (peace and blessings of Allah be upon him) is the Messenger of Allah. The main pillar of Islam is Kalima Tayyaba. Therefore, it is important to have sincerity in the heart while reciting these words. Muslims should not have any kind of doubt regarding monotheism and prophethood.

While reading these words, the focus of heart and mind should be on this word. Let it not happen that the word continues to be recited on the tongue while conspiracies against the humans of Allah are taking place in the mind. It is essential that the love of God and the love of the Messenger should be present in the heart while reciting these words. When You accepted Allah as the Lord and you accept the Prophet (peace and blessings of Allah be upon him) as Messenger, then you should get away from all kinds of pride and arrogance.

Everything in the universe was brought into existence for the belief of monotheism mentioned in the Kalima Tayyaba (first kalma), the testimony of this word was also given by the best creatures of Allah, this was also the preach of all the prophets, this is the secret of prosperity and success in this world and the hereafter. The words of first kalma is better than all the wealth of the world. Acknowledgment of the words of first kalma is the first duty for man. The remembrance of Allah in the heart is according to the faith of first kalma. The reward for the deeds that mentions first kalma (La ilaha ill Allah) is exaggerated.

La ilaha illa Allah: The best charity, the source of salvation in the grave, the heaviest in weight, intercession and acceptance on the Day of Judgment and entry into Paradise.

La ilaha illa Allah: is the part of supplications recited for Ablution, adhan, after adhan, during and after prayer, Hajj and Umrah rituals, travel, night awakening and distress. Every dua that contains first kalma has greatest chance of acceptance. On the basis of the words or first kalma, the heavens and the earth are established, everything was created due to La ilaha illa Allah, and for this reason, Allah revealed books and sent messengers to spread or preach the message of first kalma among humans.

The saying of Mustafa (may God bless him and grant him peace) is: The best Zikr is La ilaha illa Allah and the best supplication is Alhamdulillah.” (Ibn Majah, Vol. 4, p. 247, Hadith: 3800)

All of us must have read a sentence in childhood and later taught it to children again and again. After the coming of Islam, the Arab warriors who used to commit robbery, kill each other, and shed the blood of many people for small things became Muslims after reading the kalma and left all bad habits and became brothers.

So, have you ever thought that those people who were experts in fighting, stealing and robbing, murdering for many years. They used to bury their girls alive. Many used to harbor enmity for many generations. After the introduction of Islam, what happened was that they immediately left all their bad habits and became noble and started living as brothers. Islam is still the same today. And why Muslims who believe in Islam generation after generation cannot get rid of their bad habits, why are they the most notorious in the world today. The easiest answer to this is that it is all a conspiracy of non-Muslims, they want to defame and humiliate Muslims. But if you are an honest Muslim, you will examine yourself. So you will know that the real reason for this is not the conspiracy of non-Muslims but our own imperfect faith.

We say kalma but we do not give its place to its meaning in our hearts and minds because we are born Muslims. After reading this word, we did not face the pains and difficulties that the companions of the Prophet (PBUH) and the Muslims of that time faced. They not only read the words of kalma but understood its meaning and also acted on it.

Let us take some time today to understand Kalma Tayyaba. We have sometimes considered what are the requirements of the Kalima Tayyaba, which all Muslims consider to be the strong foundation of their faith, and what this words demands from us.What does it mean when we say "Laala illa Allah"? Its literal meaning is known to almost all Muslims as "There is no god but Allah". So, have you ever considered why we do not consider anyone as a god except Allah and what are the qualities and attributes that no one else in this universe has. As we ponder, this fact becomes clear to us that God is real, that is, the numerous attributes of Allah are enough to make Allah the only God. If we accept a few of these qualities and attributes from the depths of our hearts, then we too will come to the path of guidance just with the blessing of this kalma, just like the warrior tribes of Arabia.

- The first quality without believing in which our faith cannot be complete is that Allah is present and watcher, that is, Allah is the only entity who is present everywhere in the entire universe, from the hearts of humans to the caves built in the mountains. Allah is the one who sees and hears everything even in the dark corners.

- The second quality is that he does not need anyone's help to run this universe, Allah alone is sufficient to run this entire universe. That is, Allah has no partner.

- The third quality is that Allah is the only one who provides sustenance to all living beings in this universe. No one can give sustenance to any inanimate and living beings except the one whom Allah himself makes a source of sustenance. Whether they are humans or jinns, birds or animals, beasts, living creatures living at the bottom of the sea or creatures living across the sky, it is Allah's responsibility to provide sustenance to all beings, and Allah fulfills this responsibility. It is maintained in a good way.

- Allah is the One who created all creatures. No matter how much science has progressed and all the scientists of the world can not create an organism equal to a small ant. The Most Merciful Allah created humans, jinns, animals, cattle, birds, beasts and innumerable living beings and placed in them various creative abilities, but living things can use these abilities with the order of Allah, Whose Power is in the Possession of Allah through the living things soul.

When we keep an eye on some of the above-mentioned qualities and attributes of Allah, then nothing can stop us from the path of guidance and nearness to Allah. That is, when we believe from our heart that Allah is present everywhere and is watching us, that Allah is the one who knows our every move and every small evil and good thing that comes in our heart, then it is not possible. That we should do or think anything that our true God has forbidden.

In this way, we will not mix the qualities and attributes of any worldly personality with the attributes of Allah, even the most respected person in the world, the Prophet ﷺ, because he is the beloved Prophet and Messenger of Allah.

Children are the greatest weakness of man. And this has been mentioned in the Qur'an by Allah Ta'ala Himself in a very clear way. When someone does not have children, the devil would lead them astray from the path of Allah and force to bow down to fake Gods through taweez or the practice of placing chadors on shrines or making vows. It is certain that a person will go astray if he/she does not have the belief in Allah as firm like as the sun rises every day. Allah has the power to give birth to someone. If this were not the case, in today's advanced era when medical science has made unlimited progress. Man has reached the moon and has invented many things, but the scientists of the whole world are not able to create a child, otherwise millions of people would not be childless today. It is only because of this perfect belief in Allah that a person can save your faith and belief in not having children that Allah alone has the power of creation.

If you want to ask for children, you should ask for it from a superior being. Although Allah is so glorious that Allah gives all the blessings of the world even to those who ask with stones. The only difference is that those people either do not believe in Allah from the beginning or they are wandering in error after believing, and Allah looses them in their error and leaves them to go astray and all their desires and wishes are fulfilled and they spend their whole lives in delusion, being intoxicated by their own intoxication.

On the contrary, a true believer who knows and understands the Word of Tawheed expresses all his desires and wishes to Allah and prays and hopes that they will be fulfilled, and thanks to Allah's mercy and grace for those prayers that are fulfilled. a true believer lives happily in the hope that Allah will reward him for deprivation of unfulfilled prayers in the Hereafter.

The second part of Kalima Tayyaba "Muhammad is the Messenger of Allah" which completes our faith, i.e. believing that Muhammad is the Messenger of Allah after the Oneness of Allah. Here, Allah has also defined the limits of our love for Muhammad ﷺ that we should believe that the Prophet ﷺ is the Prophet and Messenger of Allah. That is, the original faith is monotheism and you are the means of conveying the message sent by Allah to us, and the honorable person whom Allah chose to reveal the last book (Holy Qur'an). Therefore, it is our duty to respect the most honorable person who brought the Book of Allah and respect in such a way that he is dearer to us than everything and relationship in the world, but we recognize the status of Muhammad.

Here, I think it is important to explain another misunderstanding that people have automatically assumed that because we Muslims are from the ummah of Muhammad ﷺ, therefore due to the intercession of Muhammad, Jannah is destined for us. This is absolutely not the case, no one will be able to intercede in the Day of Judgment without the permission of Allah.

Have you ever met a person who brought you instructions from a great ruler and you did not obey any of his instructions, but you expected that the person who brings instruction will Recommend you to the ruler from whom those orders came. How will someone recommends you for the post of minister and advisor, if you did not obeyed the orders. So how can we think that we will openly disobey Allah and His Messenger.

If we all understood the importance and excellence of Kalima Tayyaba, then like the warrior tribes of Arabs, we would read the Kalima and leave all our bad habits and start living as brothers and sisters like true believers.

May Allah help us to understand the true spirit of Kalima Tayyaba. (Ameen)

Reciting La ilaha illallah 70000 times benefits: Hazrat Sayyiduna Sheikh Muhyiddin Ibn Arabi says: This hadith reached me: "Whoever recites La ilaha illa Allah seventy thousand times, will be forgiven, and the one for whom it is recited will also be forgiven.” I had read Kalma Tayyaba 70000, but I did not intend it for anyone. Once I attended a feast with my friends. One of the participants in this feast was a young man with a great knowledge of Kashf. While eating, that young man started crying. I asked him the reason, he said: I see my mother suffering from punishment. I blessed the reward of 70000 times recitation of kalma to his mother in my heart. That young man immediately started smiling. And said: Now I see my mother in the best place.

Hazrat Sayyiduna Sheikh Muhyiddin Ibn Arabi, may God have mercy on him, used to say: "I recognized the authenticity of the hadith through the discovery of this young man, and the authenticity of the discovery of this young man through the hadith." (Marqat al-Mufatih, vol. 3, page. 222)

The reference of the 70000 times recitation hadith is weak.

Second Kalma: The second kalma is called Shahadat, which is a literal confession of Muslim faith.

The words of this kalma translitrated into english as "ashhadu alla ilaha illallah wahdahu la sharika lahu lahu wa-ash-hadu anna Muhammadan abduhoo wa rasooluhu" and the translation is "I bear witness that there is none worthy of worship except Allah, the One alone, without a partner, and I bear witness that Muhammad is His servant and Messenger". This is also more or less proven by the hadiths, and in the hadiths the virtue of reading it has been described.

The Messenger of Allah (peace and blessings of Allah be upon him) said, "Whoever recites this dua a hundred times a day, La ilaha illallah wahdahu la sharika lahu lahul mulku walahul hamdu wa owa ala kulli shayenqadir. So the recitor will get a reward equal to freeing ten slaves, a hundred good deeds will be written in book of deeds and a hundred bad deeds will be erased.This dua will protect him from Satan throughout the day. Until it is evening and no one will come with a better deed than the recitor, except the one who recites this words more than 100 times (Sahih Bukhari 3293).

Third Kalma: The third kalma is called Tamjeed. The transliteraiton of third kalma is "Subhaana-llaahi Walhamdu Lillaahi Walaaa Ilaaha Illa-llaahu Wallaahu Akbar. Walaa Hawla Walaa Quwwata Illaa Billaahi-l ‘Aliyyil ‘Azeem", and the translation is " Glory be to Allah and all praise be to Allah, there is none worthy of worship except Allah, and Allah is the Greatest. There is no might or power except from Allah, the Exalted, the Great One".

The words of this kalma are mentioned separately in two different hadiths. The first hadith is given in the Muslim and the second is given in bukhari sharif.

Fourth Kalma: The fourth kalma is called Tawheed. The transliteraiton of fourth kalma is " Laaa Ilaaha Illa-llaahu Wahdahoo Laa Shareeka-lahoo Lahu-l Mulku Walahu-l Hamdu Yuhyee Wayumeetu Wahuwa Hayyu-l Laa Yamootu Abadan Abada. Dhu-l Jalaali Wal Ikraam. Biyadihil Khair. Wahuwa Alaa Kulli Shai-’in Qadeer.", and the translation is "There is none worthy of worship except Allah. He is alone and has no partner. To Him belongs the Kingdom and for Him is all praise. He gives life and causes death. In His hand is all good and He has power over everything".

Some of these words are definitely from the Holy Qur'an, but these words are not proven in this order.

Fifth Kalma: The fifth kalma is called astaghfar. The transliteration of fifth kalma is "Astaghfiru-llaaha Rabbi Min Kulli Dhambin Adhnabtuhoo ‘Amadan Aw Khata-an Sirran Aw ‘Alaaniyata-wn Wa-atoobu Ilaihi Min-adh Dhambi-l Ladhee A’lamu Wamina-dh Dhambi-l Ladhi Laaa A’lamu Innaka Anta ‘Allaamu-l Ghuyoobi Wasattaaru-l ‘Uyoobi Wa Ghaffaaru-dh Dhunubi Walaa Hawla Walaa Quwwata Illaa Billaahi-l ‘Aliyyil ‘Azeem.", and the translation is "I seek forgiveness from Allah, who is my Creator and Cheriser, from every sin I committed knowingly or unknowingly, secretly or openly. I also seek His forgiveness for all sins which I am aware of or am not aware of. Certainly, You (O Allah!), are the Knower of the hidden and the Concealer of mistakes and the Forgiver of sins. And there is no power and no strength except Allah, the Highest, the Greatest".

These words are not mentioned anywhere in the Qur'an and Hadith in this order.

Sixth Kalma: The sixth kalma is called Radde kufr. The transliteration of sixth kalma is "Allaa-humma Inneee A’udhu-bika Min An Ushrika Bika Shay-awn Wa-ana A’lamu Bihee Wa- astaghfiruka Limaa Laaa A’lamu Bihee Tubtu ‘Anhu Wata-barraatu Mina-l Kufri Wash-shirki Wal-kidhbi Wal-gheebati Wal-bid’ati Wan-nameemati Wal-fawahishi Wal-buhtaani Wal-m’aasi Kulli-haa Wa-Aslamtu Wa-aqoolu Laaa Ilaaha Illa-llaahu Muhammadu-r Rasoolu-llah", and the translation is " O, Allah! I seek refuge in You from that I should ascribe any partner with You knowingly. I seek Your forgiveness for the sin of which I have no knowledge. I repent from it. And becoming disgusted by disbelief and idolatry, lying and backbiting, innovation and slander, lewdness and abomination, and all other acts of disobedience, I submit to Your will. I believe and declare that there is none worthy of worship except Allah and Muhammad is the Messenger of Allah".

These are also prayer words whose origin is unknown.

Summary

The 6 kalma were made famous by scholars in the sub-continent because the people were unfamiliar with Arabic, so they taught them prayers in short words, but there was a disadvantage of following them consistently and strictly, just like Surah Yaseen. Exaggerations were used in virtue, innovations were invented. As a result, people ignored the best surahs like Surah Al-Baqarah and Surah Al-Kahf. And also deprived of proven virtues.

In exactly the same way, these 6 kalma were exaggerated in intensity and virtue, so that the majority of our children were deprived of Sayyid al-Istighfar and Masnoon Azkar in the morning and evening. Most of them only contain some Quranic words in Arabic. There are words contains the praise of Allah - no Shariah evidence is found with the above order and the above names. There is no compulsion to memorize them all and memorizing the duas of the Prophet (may God bless him and grant him peace) mentioned in the hadith if better. It is even better to remember the words and prayers that are present in the hadith that are confirmed by the Prophet.

People are being made to believe that whoever does not remember or memorize these 6 kalma has a weak faith. Not remembering words is not a measure of faith, nor is it an extra virtue. There can be two opinions on making a collection by collecting the words of Masnoon, but imposing it on the public is nothing but pure ignorance.

Misconception about 6 kama: There is a misconception about these six kalmas that every Muslim must memorize it. Which is a wrong concept about these kalmas. Memorizing the 6 kalmas is not a measure of faith, nor is it an extra virtue. Imposing it on the public is nothing but pure ignorance.

Note: It should be clear that this sequence and number is not proven by hadith.